In this course, I am going to talk about two healthcare coding systems; The Healthcare Common Procedure Coding System, which we refer to as HCPCS, and the International Classification of Diseases which we refer to as ICD-10 codes. Then, at the end of the presentation, I have left time for some practice scenarios to give some application to the concepts that I've covered.

Healthcare Common Procedure Coding System (HCPCS)

The first coding system is the HCPCS codes. We have HCPCS Level I and their current procedural terminology. We rarely hear that phrase being used, usually we hear “CPT codes”. So HCPCS Level I is CPT codes.

HCPCS Level II are codes that are used to report supplies, equipment and other devices. So, for SLPs, and especially for those of us specializing in voice, that would include our TEP supplies or electrolarynx. It also applies to alternative and augmentative communication devices as well.

HCPCS Level I - Current Procedural Terminology (aka CPT Codes)

I'm going to focus mainly on the CPT Level I because those are the codes that we use most. These are codes that represent every single medical, surgical, and diagnostic procedure that we have, and they are assigned a five digit code. A CPT code represents what we do, current procedural terminology, what procedures we are going to perform or provide to the client and the patient.

Why do we have these CPT codes? They provide a common language among all providers and our payers and administrators. They also give a standardized descriptions of procedures. And another thing that I've gotten to know a great deal about over the last 10 years is that they provide data for the government to look at our utilization patterns; such as who's billing this procedure? How many times is this procedure being used? How many times has one procedure combined with another procedure? Also, these codes provide a lot of data for health-related research.

At this time, we actually have over 10,000 CPT codes. It's important to remember that CPT codes - this HCPCS Level I - is developed, maintained, and copyrighted by the American Medical Association, not the government. It's owned by the American Medical Association, and is actually a continuous process which gets updated annually.

HCPCS Level II - Supplies, Equipment, Devices, and Procedures not found in the CPT system, e.g., durable medical equipment (DME)

Now, a bit more about Level II so you have this information. Again, Level II refers to the supplies, equipment, devices and any procedures that are not found in the CPT system. Durable medical equipment is found under Level II. This is administered by the Centers for Medicare and Medicaid Services, not by the American Medical Association.

These codes begin with a single letter, and are followed by four numbers. So for those of us in voice, the most common would be perhaps the code for artificial larynx, any type which is an L8500. There's also a code for tracheoesophageal voice prostheses (L8509) which are grouped by the type of service or the supply that they represent.

Again, these codes are also updated annually, and there are also Medicare claims for E and L codes and V codes, which all fall under the jurisdiction of Durable Medical Equipment Medicare Administrative Contractors (DME MACs). I'll discuss with you a little further to familiarize you with what a MAC is in case you don't know.

But for more information on any of the coding systems that I'm reviewing in this course, there is a reference that is available for free on the ASHA website where all these things are listed and explained: www.asha.org/practice/reimbursement/coding/hcpcs_slp/.

HCPCS Level I - Voice and Resonance CPT Codes for SLPs

I'm going to spend the rest of the time discussing HCPCS Level I, rather than Level II. I'm not going to read each of these to you, but for those of us who practice in voice and resonance, these are the most common CPT codes that we use in our daily practice.

- CPT 31579 Laryngoscopy, flexible or rigid fiberoptic, with stroboscopy

- CPT 92507 Treatment of speech, language, voice, communication, and/or auditory processing disorder; individual

- CPT 92511 Nasopharyngoscopy with endoscope (separate procedure)

- CPT 92520 Laryngeal function studies (i.e., aerodynamic testing and acoustic testing)

- CPT 92524 Behavioral and qualitative analysis of voice and resonance

- CPT 92597 Evaluation for use and/or fitting of voice prosthetic device to supplement oral speech

For example, CPT 31579 is for laryngoscopy, flexible or rigid scope, with stroboscopy. Next, treatment of speech, language, voice communication and/or auditory processing disorder for one individual is CPT 92507. I will be talking about these other codes more in-depth as I go through presentation.

CPT Relative Value Unit (RVU) - How is payment for procedures determined?

I think it's important to know how a procedure gets a value, because that's always a question is how to know what to charge? How do we know what to bill? Why can't we bill this? Why is this procedure only worth this amount? So, it’s important to understand a bit about this process.

The payment for procedures is actually determined by the resource costs needed to provide them. Every procedure or service has this resource-based relative value, and what are those resources, what makes up those resources? They're actually divided into three categories:

professional work category, (2) practice expense category, and (3) professional liability insurance. Each one of these components is decided and then added together. All CPT procedures are ranked on the same scale. For example, an SLP therapy session is ranked relative to all other procedures from a primary care visit to an orthopedic surgery procedure; everything is ranked on this same scale. The CPT procedures and the ranking of the CPT procedures determines the Medicare Physician Fee Schedule.

Let's take a little closer look at what is involved in each one of these components because as we go along, you'll see how these components influence the value of the procedure.

Professional work. The first one is professional work. SLPs did not fit into professional work until 2009 and it was actually a Congressional act that recognized speech language pathologists as healthcare providers.

Professional work includes the time it takes to perform the service, technical skill and physical effort, required mental effort and judgment, and stress due to the potential risk to the patient. When we work with a patient, for example, with a tracheoesophageal prosthesis and we're changing that prosthesis, there's a great deal of risk involved in that procedure.

Practice expense. Prior to 2009, our services fell into practice expense. We were considered tech support, and so the value of what we did was considered as a practice expense. This category includes the time of support personnel (which we were considered to be), supplies, equipment, and overhead.

Professional liability. The third category is professional liability or malpractice insurance cost. Fortunately, for us, that is not a high component because we're not in the high category of being sued for malpractice. So that's a good thing.

Relative Value → Dollar Value

How does this relative value that's determined get to be a dollar value? There's a very rigorous process that's developed by the American Medical Association to determine what this relative value is based on the resources, and once that relative value is determined by the American Medical Association, they send a recommendation to CMS. CMS, then, looks at the recommendation and they can accept it, reject it, or adjust it. It is then ranked with all of the other procedures.

This RVU, which is the relative value unit, is then multiplied by a conversion factor that is determined by Congress, and that determines what the payment per procedure will be for Medicare Part B beneficiaries. Why am I just talking about Medicare Part B beneficiaries and the Physician Fee Schedule? Because most of the other private health carriers adapt this Medicare Physician Fee Schedule to use as their own. Therefore, it's important to know about the fee schedule and how it is created.

The conversion factor for 2018 is almost $36. This is also adjusted for geographic location. So if you look at the Medicare Physician Fee Schedule, you can look at the adjustment for where you live even within a state. I live in the state of Florida but I don't live in Miami. The cost of living in Miami is higher than where I live, so those who work and bill in Miami are going to receive a bit more from CMS for the procedure than I will.

Relative Value - 2018 Reimbursement for CPT 92524

Let's look at 92524, which is behavioral and qualitative analysis of voice and resonance, and it's a non-instrumental assessment. The total relative value for this is $2.49. If we break that down, the professional work category got a $1.50, practice expense was determined to be $0.92, and the malpractice is $.07. And actually, that is probably one of the highest malpractice components that we have. The Medicare Part B payments then is that $2.49 multiplied by the conversion factor ($35.9996) which equals $89.64. Again, there would be a local adjustment to that.

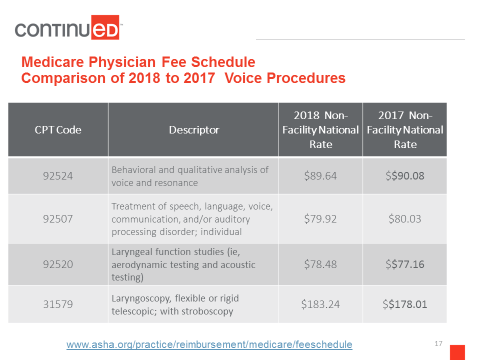

Figure 1 is an example what ASHA does when the Medicare Physician Fee Schedule comes out. It usually comes out around the first of November, right before the ASHA convention. Hopefully they give us at least a week so that staff can pull all this information for us and we can present it at the convention. They go through this huge document, and ASHA staff will pull together and put the codes that are relative to speech-language pathology and audiology, give a description, and then they will publish two rates: the non-facility rate for 2018 and the non-facility rate for 2017.

Figure 1. Medicare physician fee schedule: comparison of 2018 to 2017 voice procedures.

If you view the full version of the Medicare physician fee scale, there is a non-facility rate and a facility rate. SLPs, as well as PT and OT, are under the non-facility rate, which is usually a bit higher than the facility rate. Again, you can go to the website to get all of the codes.

Other Factors to Consider

There are actually many other factors to consider when calculating reimbursement for a Medicare Part B service. But these are some of the most pertinent to discuss:

- Facility & Non-Facility Rates

- Multiple Procedure Payment Reductions (MPPR)

- Medicare Provider status

- Non-Participating versus Participating Health Care Professional Provider

- Incident to physician

- Therapy Cap and Exceptions Process

Facility & non-facility rates. I have already briefly described a facility and a non-facility rate. Again, SLP services are allowed at non-facility rates in all settings. Even if you're working in a facility, SLP services are still allowed at a non-facility rate because of a section in the Medicare statute that allows that to occur

Multiple procedure payment reduction (MPPR). This is a per day Medicare policy that applies across all disciplines and settings. MPPR applies to therapy procedure codes that are billed to Medicare Part B on the same date of service regardless of discipline (ST, PT, OT). The code with the greatest Practice Expense (PE) component gets full payment, and the others have a 50% reduction in the practice expense. This is why it’s important to realize that there are three components in the fee. It's not 50% of the therapy fee, it's 50% of the practice component of the therapy fee.

There are eight SLP CPT codes that fall under MPPR. Actually, most of our codes fall under that, except for 31579 and 92520, which are codes that voice specialists use. Those codes are not included in the MPPR, which is a good thing. But it does involve 92524, which is our evaluation and therapy, so you can provide the evaluation and also begin therapy on the same date of service. However, when you do so, there will be a slight reduction. Take a look at the example:

- Based on 2018 MPFS, CPT 92524 (Eval) and 92507 (Tx) billed on the same day for the same beneficiary

- CPT 92524 PE = 0.92, $33.12

- CPT 92507 PE = 0.87, $31.32

- Therefore, 92524 gets paid in full ($89.64) but 92507 has PE reduced by 50% ($15.66); provider receives $64.26 rather than $79.92

Again, the PE component for 92524 is 0.92, which is about $33. The PE component for therapy is 0.87. Since there is a difference, the one with the largest PE will get paid in full, and the second one will have a 50% reduction. So, for this example, the provider receives $64.26, rather than $79.92 if they were done on separate days.

Remember that this is across all services, so if you are working in an outpatient facility and PT and OT are being provided on the same day to your patient, then it applies across disciplines. So the procedure that day that has the highest PE gets paid in full, and all the other procedures that are provided to your patient that day will have a 50% reduction. And this applies to Medicare Part B (i.e., outpatient).

Medicare provider status. When you enroll, you have a choice to be a participating provider or a non-participating provider. However, even if you're a non-participating, you are still registered as a Medicare provider.

I'm only comparing these briefly in this course. If you are a participating provider that means that the provider (i.e., you) submits the 1500 claim form to Medicare for reimbursement and you use the Medicare Physician Fee Schedule rates that I just discussed. You collect 20% from the patient, unless your patient has a secondary provider. If they have a secondary provider that kicks in the 20% (remember that the fee schedule, Medicare reimburses 80% of that, and 20% is the responsibility of the beneficiary).

Some beneficiaries have a secondary insurance. If they do, Medicare will forward the claim to the secondary or Medicaid, should it be Medicaid, for additional processing, and then Medicare sends the payment to you. In a nutshell, that's the participating Medicare provider.

For non-participating, the patient submits the claim for reimbursement. You accept assignment on a case-by-case basis, and there is a formula for determining what the rate is (formula: 115% of 95% of MPFS). The provider (i.e., you) collects the full amount from the patient at the time the service is provided. This is not an option if the patient has Medicaid, only Medicare Part B. Medicare issues the payment to the beneficiary; the beneficiary submits the paperwork to Medicare and the payment comes to them. The beneficiary pays you up front.

That's a comparison of the two in a nutshell, but you should definitely learn more about it. My point is that I want you to know that you have a choice, and a lot of times, this isn't even brought up, and you don't realize that you have a choice. You think it's just kind of an all-or-nothing, one way or the other, and it's not.